Empowering India's Future: Harnessing Solar Energy with Our Solar Farm Initiative

In today’s corporate landscape, many businesses are actively pursuing renewable energy sources to power their operations, driven in part by global initiatives such as RE100 gaining traction. While rooftop or onsite solar installations serve as effective starting points, numerous companies face constraints in space within their facilities to accommodate large-scale solar power systems capable of meeting their energy demands. In an era marked by environmental consciousness, solar farms have emerged as beacons of sustainable energy.

To address this challenge, grid-connected or ‘Open Access’ solar power emerges as a viable solution, enabling businesses to access substantial electricity through the grid, potentially meeting up to 100% of their energy requirements. Transitioning to renewable energy offers businesses a dual benefit: significant cost savings on electricity and notable progress toward achieving 100% renewable energy sourcing. Open access solar power stands out as a favored generation option, providing enterprises with the opportunity to fulfill their electricity needs at rates lower than prevailing grid tariffs.

Example

The graph below illustrates the advantages of opting for offsite open access solar farms in India for power procurement. It takes into account the variations in solar power generation throughout the year, as well as the existing banking restrictions in the Indian energy market.

Consider a scenario where a large corporate entity requires a consistent and uninterrupted power supply of 100 units throughout the year, regardless of the time of day or season. In such a case, relying solely on an open access solar farm can fulfill only 60 units of the total electricity requirement. This implies that for every 100 units of electricity needed, solar energy can substitute for approximately 60% of the demand, ensuring a reliable and sustainable power supply.

It’s important to note that this estimation considers the limitations imposed by banking restrictions, which dictate how surplus solar energy can be stored and utilized. By leveraging open access solar farms, businesses can not only mitigate their reliance on conventional energy sources but also capitalize on substantial savings, potentially reducing annual electricity bills by at least 25%.

This analysis underscores the significance of strategic energy procurement decisions and highlights the potential benefits of integrating renewable energy solutions into corporate power strategies.

You have the option to obtain affordable renewable energy through any of the following models.

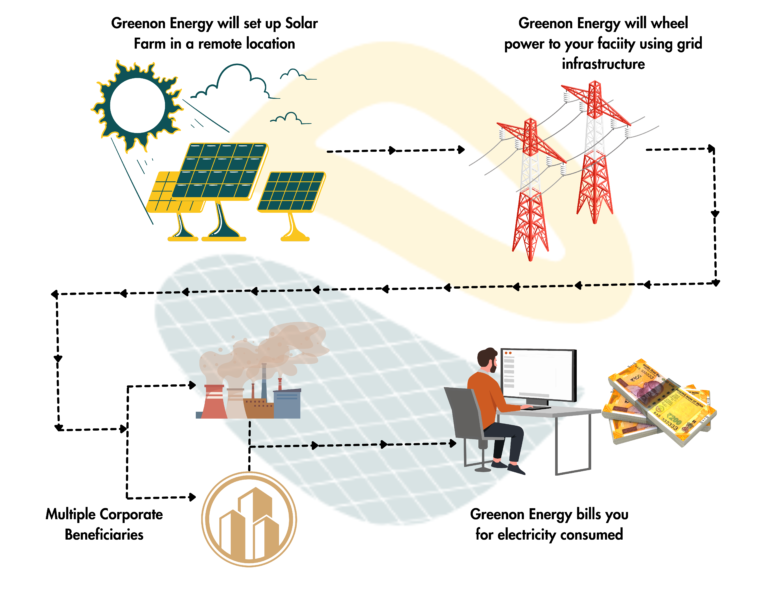

Third Party Access (Open Access)

At Greenon Energy, we can fulfill all your business electricity requirements by providing renewable energy sourced from our offsite private Solar farms, Wind farms, and Wind Solar Hybrid (WSH) Farms spread across India. The tariffs for open access power are considerably more economical than those from the grid.

Additionally, this model enables consumers to overcome the limitations associated with onsite solar installations, as it is a scalable option not restricted by space availability at your facility. With open access power, you start benefiting from affordable renewable energy right from the outset.

Numerous businesses, similar to yours, are opting for renewable power over conventional sources for various reasons. For industrial and commercial consumers, open access power ensures a consistent electricity supply at a reduced cost, simultaneously contributing to the reduction of their carbon footprint.

Benefits

- Zero upfront investment No initial investment is necessary under this energy sales model, as it operates on a zero upfront investment basis for the consumer.

- Guaranteed savings on electricity cost Assured reductions in electricity expenses are guaranteed as Greenon Energy offers electricity at tariffs significantly lower than those of the grid, ensuring savings on every unit of energy supplied.

- A solution without risk This is a risk-free, hassle-free, and capital expenditure-free option with no investment or maintenance responsibility.

- Fixed tariff assurance for the next 20-25 years By entering into a Power Purchase Agreement (PPA) with us, you secure a consistent tariff for the next 20-25 years, which is lower than current grid electricity tariffs.

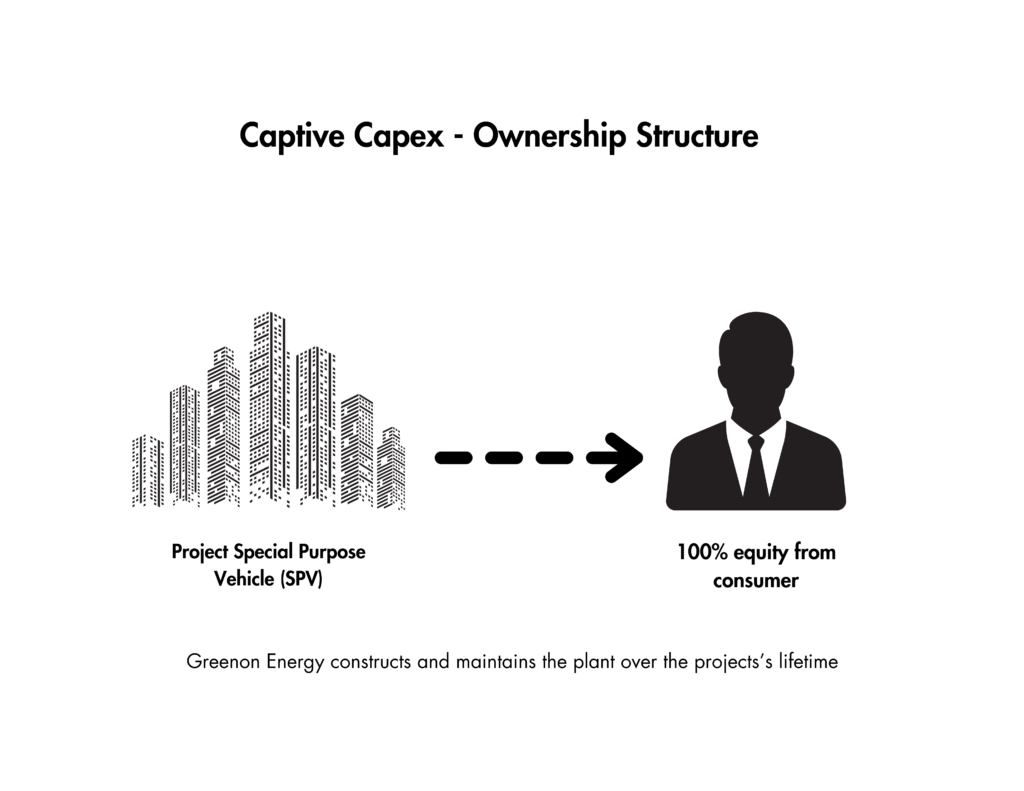

Captive

Here’s how the Captive model operates:

Under the captive capital expenditure (capex) model, the corporate purchaser of a utility-scale renewable project initiates the upfront capital investment.

The purchaser assumes ownership of the power-generating asset, utilizing the solar power generated for self-consumption. Greenon Energy oversees the construction, operation, and maintenance of the plant throughout its lifespan.

Benefits

- Hedge against electricity charges Open Access fees from the grid apply, but unpredictable charges like cross-subsidy surcharge and additional surcharge are exempted in captive and group captive projects.

- Tax benefits In this framework, a corporate purchaser who lists the asset on its financial records can also qualify for tax advantages via accelerated depreciation.

- No technical experience needed Greenon Energy will deliver a comprehensive turnkey EPC solution during the plant’s commissioning, ensuring all regulatory approvals and due diligence are in place. Furthermore, CleanMax will manage the operation and maintenance of the plant for its entire 25-year lifespan.

Group Captive

The group captive model presents a strategic alternative within the captive framework, fostering collaborative energy consumption practices among corporate entities. In this model, a project is designed to accommodate the collective energy needs of one or multiple corporate buyers. Greenon Energy orchestrates the establishment of a Special Purpose Vehicle (SPV) specifically tailored for group captive arrangements.

In this structure, corporate buyers collectively hold a 26 percent equity stake in the project and are required to jointly consume a minimum of 51% of the power generated under the Power Purchase Agreement (PPA). This collaborative approach encourages shared responsibility and accountability among participating entities.

Furthermore, Greenon Energy assumes comprehensive responsibility for the project lifecycle, including construction, operation, and maintenance. This holistic approach ensures streamlined operations and maximizes the efficiency and reliability of the project over its lifespan.

Benefits

- Minimal investment and risk are involved The corporate buyer can access the benefits of open access in a group captive project without the necessity of full project ownership. In this scenario, Greenon Energy assumes 74% of the investment burden, while the corporate buyer holds a minimum of 26% equity. This allocation is structured to fulfill ownership criteria, thereby enabling exemption from cross-subsidy surcharges.

- Assured electricity cost savings are ensured Despite the obligation to procure electricity from Greenon Energy via a Power Purchase Agreement (PPA), the rates offered are significantly lower than current grid tariffs, ensuring guaranteed savings on every unit utilized.

- No technical expertise required Greenon Energy offers a comprehensive turnkey Engineering, Procurement, and Construction (EPC) solution during plant commissioning, handling all regulatory approvals and due diligence. Furthermore, Greenon Energy undertakes the operation and maintenance of the plant throughout its 25-year lifespan.

FAQ

Most frequent questions and answers

In such projects, the corporate buyer needs to own 26% of the equity, while the developer covers the remaining 74%. They can sign a Power Purchase Agreement (PPA) with agreed terms. Typically, the developer handles the operation and maintenance (O&M) responsibilities.

The corporate buyer should ensure full compliance with the Electricity Act and proposed amendments to the Electricity Rules for a Group Captive project by following two straightforward guidelines:

- Equity Participation: Ensure a genuine equity contribution, amounting to 26% of the equity cost, based on a 70/30 debt to equity ratio.

- Economic Participation: Guarantee that all shareholders possess paid-up equity share capital with complete rights, including value, share of profit/dividends, capital appreciation, voting rights, and share transfer capabilities.

As per regulatory requirements, if the lead captive buyer owns at least 26 percent of the power generating plant, ownership needs to be transferred to another captive buyer or back to the primary investor in case the PPA terminates or expires. Parties often establish a put/call option structure to transfer the shares when the PPA expires or terminates. If either the captive generator or the buyer is a non-resident or foreign-owned and controlled entity, the subscription/purchase of equity shares and subsequent transfer must comply with the Reserve Bank of India’s pricing guidelines.

Utility-scale grid-connected Open Access plants play a crucial role in meeting the significant power requirements of corporations that may not be feasible with typical rooftop solar power plants, mainly due to space limitations.

Usually, two procurement models are employed: third-party Power Purchase Agreements (PPAs) and captive or group captive models.

Open access charges within a utility-scale renewable project fluctuate depending on location and procurement models. The assorted charges within the Open Access mechanism encompass:

– Transmission charges

– Wheeling Charges

– Transmission losses

– Wheeling losses

– Cross-subsidy surcharge (CSS)

– Additional surcharge (AS)

– Banking charges

- Conducting due diligence according to company locations

- Assessing Open Access Risks

- Performing Due Diligence on the developer

- Negotiating Power Purchase Agreements (PPAs)

Contractual Challenges:

- Tenor mismatch between PPA & loan

- Contract enforcement

- Contract standardization

Operational Challenges:

- Grid curtailment risk

- Performance risk

Regulatory Challenges:

- Uncertainty around Open Access regulations and charges

- Inconsistency in eligibility and operating criteria for Open Access

- Exclusion from Open Access

- The utilities point of view

- Paper-based approval process